New Tax Insights for Small Businesses

By Gregory P. Blenkush, August 10, 2018

How do I know if I am eligible for the 20% tax deduction? Am I a qualified trade or business or am I a specified service trade or business? As a small business owner, what can I do, if anything, to maximize this deduction and reduce federal taxes? If I’m not currently eligible for the deduction, is there anything I can do to qualify? There are a lot of questions swirling around about the 2018 tax changes, especially in regards to how they’ll impact small businesses. We’ve spent some time reading up on the implications of the changes, and preparing to help our clients through it all.

Do You Qualify?

To begin answering some questions you may have, we’ll start by asking you one more: Have you checked with your accountant to see how much the Tax Cuts and Jobs Act will save you in federal income taxes? The qualified business income deduction is a nice break for business owners, if you qualify, so it’s worth a quick sit down with your accountant to determine your eligibility.

As an example, I had a conversation with a client last week who would certainly qualify (subject to the taxable income limits given that his income is from a specified service business). My client’s accountant hasn’t discussed this matter with him yet (my client plans on calling his accountant to ask more about this). My client is a REALTOR who receives a 1099 at the end of the year; thus, he’s potentially going to save thousands in federal income taxes. If he makes quarterly estimated tax payments, he may be paying in significantly more than he needs to be. He could keep his cash and earn interest on the balance instead of giving the treasury department an interest free loan! To prepare for a meeting with your tax advisor, consider bringing these questions to the table:

- Am I potentially eligible given my type of business and how I’m compensated?

- If I am eligible for the deduction, how much could I benefit from it without taking any action?

- Would there be any actions that I could take to increase this deduction amount on my federal income taxes?

Did You Know?

Entity structure (LLC, S Corporation, Sole Proprietorship) and the type of income (W2 wages versus distributions) can often be changed. It’s this planning throughout the year that’s important because many of these decisions need to occur prior to year end (with the exception of lowering taxable income via retirement plan contributions up to tax filing deadlines). If you’re a small business owner with qualified business income, you could save a significant amount in federal income taxes, though you may be subject to the limitation based on wages and capital. Planning throughout the year may be necessary to qualify for this deduction (via reduction of taxable income). Business owners may need to reevaluate their business structures (S Corporation versus LLC, etc.) and/or increase retirement contributions to bring down taxable income).

If you have qualified business income and your overall household taxable income is at or within the phaseout range, there could be planning opportunities prior to year end. If your taxable income can be reduced via additional retirement plan contributions, that’s the easiest action to take. Entity structure and income shifting would likely require a fair amount of work and due diligence, but it may be worth it.

Asking The Right Questions

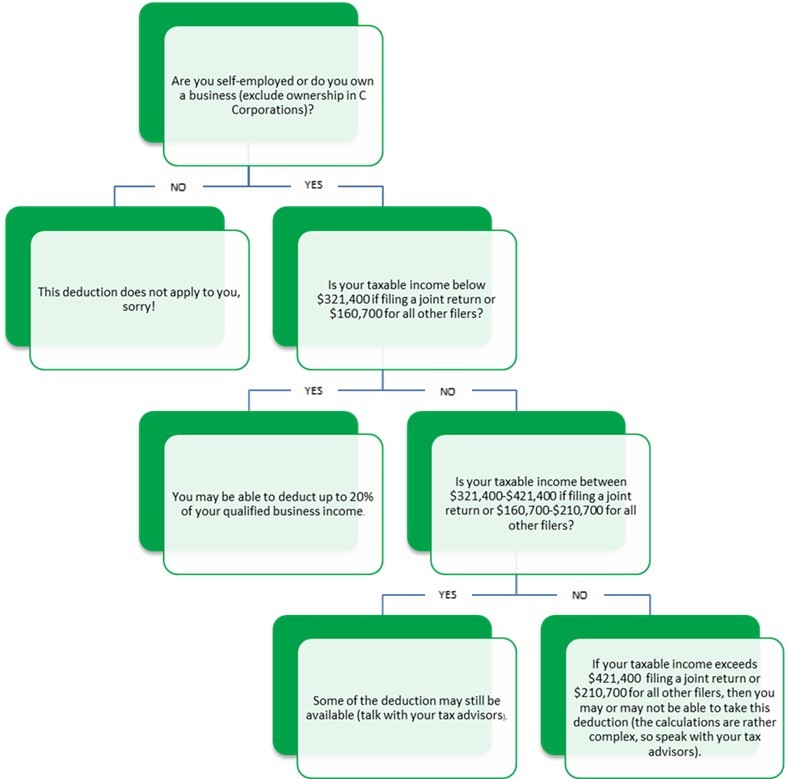

Depending on who you are, there are specific aspects of the tax law to consider as particularly applicable to you. Use the flowchart below to educate yourself (updated for tax year 2019).

We’d love to help sort through your unique situation in even more detail. We work closely with clients to integrate tax law and tax considerations into our financial planning and wealth management services. We also collaborate with your tax attorneys and CPA as needed to create a holistic approach to your tax and wealth management needs. And be proactive–schedule a time now to talk to your accountant, so all changes and actions can be made before December 31!

The information herein is for illustrative purposes only. This is a general education article, and should not be construed as tax advice, and may not be the applicable to your specific situation. Except for the historical information contained in this report, certain matters are forward-looking statements or projections that are dependent upon risks and uncertainties, including but not limited to such factors and considerations such as general market volatility, global economic risk, geopolitical risk, currency risk and other country-specific factors, fiscal and monetary policy, the level of interest rates, security-specific risks, and historical market segment or sector performance relationships as they relate to the business and economic cycle. The information contained in this report has been gathered from sources we believe to be reliable, but we do not guarantee the accuracy or completeness of such information.We do not provide legal, tax, or insurance advice. If you require legal, tax, or insurance advice, please consult the appropriate qualified professional.

Client Login Links

Login to the Cahill Client Portal or directly to your account custodian's website:

Continue on to the Schwab website?

You are now leaving the Cahill Financial Advisors, Inc. website and will be entering the Charles Schwab & Co., Inc. ("Schwab") Website.

Schwab is a registered broker-dealer, and is not affiliated with Cahill Financial Advisors or any advisors whose names appear on this Website. Cahill Financial Advisors is independently owned and operated. Schwab neither endorses nor recommends Cahill Financial Advisors. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Cahill Financial Advisors under which Schwab provides Cahill Financial Advisors with services related to your account. Schwab does not review the Cahill Financial Advisors Website, and makes no representation regarding the content of the Website. The information contained in the Cahill Financial Advisors Website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

Continue on to the Fidelity website?

You are now leaving the Cahill Financial Advisors, Inc. website and will be entering the Fidelity., Inc. ("Fidelity") Website.

Fidelity is a registered broker-dealer, and is not affiliated with Cahill Financial Advisors or any advisors whose names appear on this Website. Cahill Financial Advisors is independently owned and operated. Fidelity neither endorses nor recommends Cahill Financial Advisors. Regardless of any referral or recommendation, Fidelity does not endorse or recommend the investment strategy of any advisor. Fidelity has agreements with Cahill Financial Advisors under which Fidelity provides Cahill Financial Advisors with services related to your account. Fidelity does not review the Cahill Financial Advisors Website, and makes no representation regarding the content of the Website. The information contained in the Cahill Financial Advisors Website should not be considered to be either a recommendation by Fidelity or a solicitation of any offer to purchase or sell any securities.

Continue on to the SEI Investments website?

You are now leaving the Cahill Financial Advisors, Inc. website and will be entering the SEI Investmensts Website.

SEI Investmensts is a registered broker-dealer, and is not affiliated with Cahill Financial Advisors or any advisors whose names appear on this Website. Cahill Financial Advisors is independently owned and operated. SEI Investments neither endorses nor recommends Cahill Financial Advisors. Regardless of any referral or recommendation, SEI Investments does not endorse or recommend the investment strategy of any advisor. SEI Investments has agreements with Cahill Financial Advisors under which SEI Investments provides Cahill Financial Advisors with services related to your account. SEI Investments does not review the Cahill Financial Advisors Website, and makes no representation regarding the content of the Website. The information contained in the Cahill Financial Advisors Website should not be considered to be either a recommendation by SEI Investments or a solicitation of any offer to purchase or sell any securities.